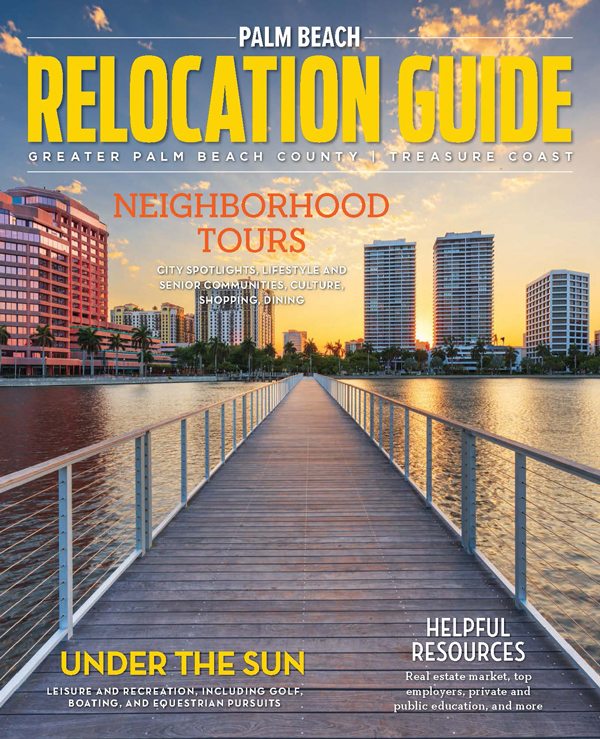

Florida is experiencing a strong housing recovery, with many buyers from overseas offering cash for high-end homes across South Florida. According to CNBC, 21 percent of all U.S. real estate sold to overseas buyers was in Florida. In November 2015, the Sun-Sentinel reported that a surge in single-family housing sales during the year is making for buyer competition over available houses.

The Realtors Association of the Palm Beaches (RAPB) reported in November 2015 that the median sale price of a single family home was $295,000, up 11.3 percent from November 2014. Sales in the county were brisk, with houses selling on average within 37 days of being listed for sale. The median price for a condo was $140,000, up 5.3 percent from the previous year. The RAPB believes the market is close to achieving balance between the numbers of buyers and sellers.

Buyers may still need to show flexibility as they shop the market, and be prepared to take action when they find a home that meets most of their criteria. With construction going on all over Palm Beach County, including urban mixed-used developments as well as single family homes, the balance predicted by the RAPB should occur soon.

According to figures issued by the Palm Beach County Property Appraiser in 2015, property values have been on the rise in Palm Beach County for the past four years, and taxable values on 600,000 properties in the county increased by 9 percent from 2014 to 2015, adding $152 billion to the county’s tax revenue. This indicator of economic health is welcomed by property owners, as the value of their investments are rising. The high interest in home buying is one of the factors driving increased property values, and with increased tax revenue bringing improvements to infrastructure, city and county services, expect to see this upward trend in value reinforced. Even with most millage rates remaining flat, cities across Palm Beach County are collecting more income due to the rise in property values.

Riviera Beach saw the biggest property value increase in the county last year, with a 32 percent jump from 2014. Other cities with notable increases were West Palm Beach (12 percent), Delray Beach (10 percent), Boynton Beach (9 percent) and Boca Raton (7 percent).

The pressure for more housing – and the supporting infrastructure and services that come with it – is leading to new development across the county. Expect to see additional development west of existing cities. Just as Dade and Broward Counties have converted large tracts of inland farmlands to suburban development over the past 40 years, the rapidly expanding population of Palm Beach County will likely increase pressure to develop new cities and suburbs inland from the highly populated Eastern coastline.

Overall, the trend in Palm Beach County is for more housing and development, rising population, rising property values, and growth in infrastructure and services – all supporting an expanding business climate!

Facebook Comments